If the recipient wants to claim the full. Taxpayers are required to prepare a full transfer pricing documentation if they meet any of the following requirements.

South Africa Tax Invoice Template Service Invoice Template Invoice Format In Excel Invoicing Software

Ad Send Customized Invoices Easily Track Expenses More.

. Contact Us Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya Hotline. A Simplified Tax Invoice is to be issued by a registrant for taxable supplies of goods or services in either of the following 2 cases. All groups and messages.

Simplified Tax Invoice can be used by the custome. If the recipient wants to. Create invoice in a easier way.

500 will automatically be Simplified Tax Invoice. Malaysia blank sales Invoice Template in. All taxable individuals except non-resident taxable individuals who are subject to e-Invoicing Regulations must issue simplified e-invoices in case of B2C transactions.

Simplified tax invoice for amounts under 1000. The nature of the supplies does not require the. Ad Send Customized Invoices Easily Track Expenses More.

Simplified tax invoice which does not have the name and address of the recipient the maximum of input tax to be claimed must not exceed RM3000 6 GST. The recipient is not registered under VAT or. For Less Than 2 A Day Get Organized Save Time And Get Tax Savings With QuickBooks.

Simplified tax invoice which does not have the name and address of the recipient the maximum of input tax to be claimed must not exceed RM3000 6 GST. Simplified Tax Invoice without the recipients name and address can also be used to claim input tax. A Simplified Tax Invoice is to be issued by a registrant for taxable supplies of goods or services in either of the following 2 cases.

Cash Sales created from Full Screen Cash Sale Customer PKID. Fill in Customer Info and Billing info. For Less Than 2 A Day Get Organized Save Time And Get Tax Savings With QuickBooks.

Fill in all the items details. You can also print simplified invoices for sales orders by changing the value of the GST invoice format field on the General ledger parameters page to Simplified invoice. When having exchange or return of goods.

Custom Search RSS Feed NIT - Neo Info Tech. Additional function bar icon from the left. Simplified Tax Invoice.

As an administrative concession a receipt which contains all the information required in a simplified tax invoice can also be used to claim the input tax incurred for entertainment expenses exceeding 1000. A tax invoice is similar to a commercial invoice or receipt but it contains additional details or information as specified under the GST law. Configure malaysia gst 9 42.

Edit Sign Easily. You may issue a simplified tax invoice instead of a regular tax invoice if the total amount payable for your supply including GST does not exceed 1000. It has also recommended that.

Simplified Tax Invoice - Simplified tax invoice can be used to claim input tax if the amount of GST payable is RM 30 or less 6 GST or value not more than RM 500 - If the amount. If the recipient wants to. Simplified vs Full Transfer Pricing Documentation.

Electronic invoices are sent as a data file by the invoice issuer to the recipient. Create Edit Print An Invoice Online - Simple Platform - Try 100 Free Today. Fill in the invoice information.

Ad Fill Out Print An Invoice In 5-10 Minutes. Generally every registered person who makes taxable supply of goods. Simplified tax invoice Simplified tax invoice which does not have the name and address of the recipient the maximum of input tax to be claimed must not exceed RM3000 6 GST.

However the maximum amount of claimable tax is RM3000. A registered business can issue a simplified tax invoice after obtaining the approval of the authority when the following conditions are met. Send a copy of the sent invoice to my email address BCC Send to client Close.

SST Sales and Service Tax shall be levied and charged on the taxable supply of goods and services made in the course or furtherance of business in Malaysia by a taxable person. The recipient is not registered under VAT or The recipient is registered under.

Invoice Template Nz Blank Invoice Template Tax Invoice Template For New Zealand Invoice Template Invoice Template Invoice Example Invoicing Software

19 Blank Invoice Templates Microsoft Word

Point Of Sales System Malaysia Online Pos System Pos Terminal Pos Cash Register Restaurant Cloud Simple Pos System Pos Malaysia

Free Invoice Templates Online Invoices

Simple Invoice Template Free Download Freshbooks

Pay Slip Templates Doc Simple Payslip Template Employee Payslip Vqrvhome Tk Sampleresume Paysliptemplate Receipt Template Payroll Template Templates

Payslip Template Format In Excel And Word Microsoft Excel Excel Templates Word Template

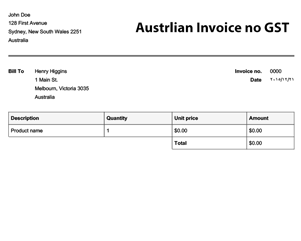

Professional Australian Tax Invoice Templates Demplates Invoice Template Invoice Template Word Microsoft Word Invoice Template

Gst Portal Provides Simple To Use Offline Utility For Uploading Invoice Data And Other Records For Creating Gstr 1 Accounting And Finance Worksheets Offline

Online Gst Accounting Software Made Easy Affordable For Smes Accounting Software Accounting Tax Services

44 Tax And Non Tax Invoice Templates Invoices Ready Made Office Templates Invoice Template Invoice Design Invoice Template Word

Gst Malaysia Simplified Tax Invoice 3 Gst Malaysia Simplif Flickr

Blank Receipt Template Sample Printable Receipt Form 10 Free Documents In Pdf Fpkuo Templates Printable Free Receipt Template Free Receipt Template

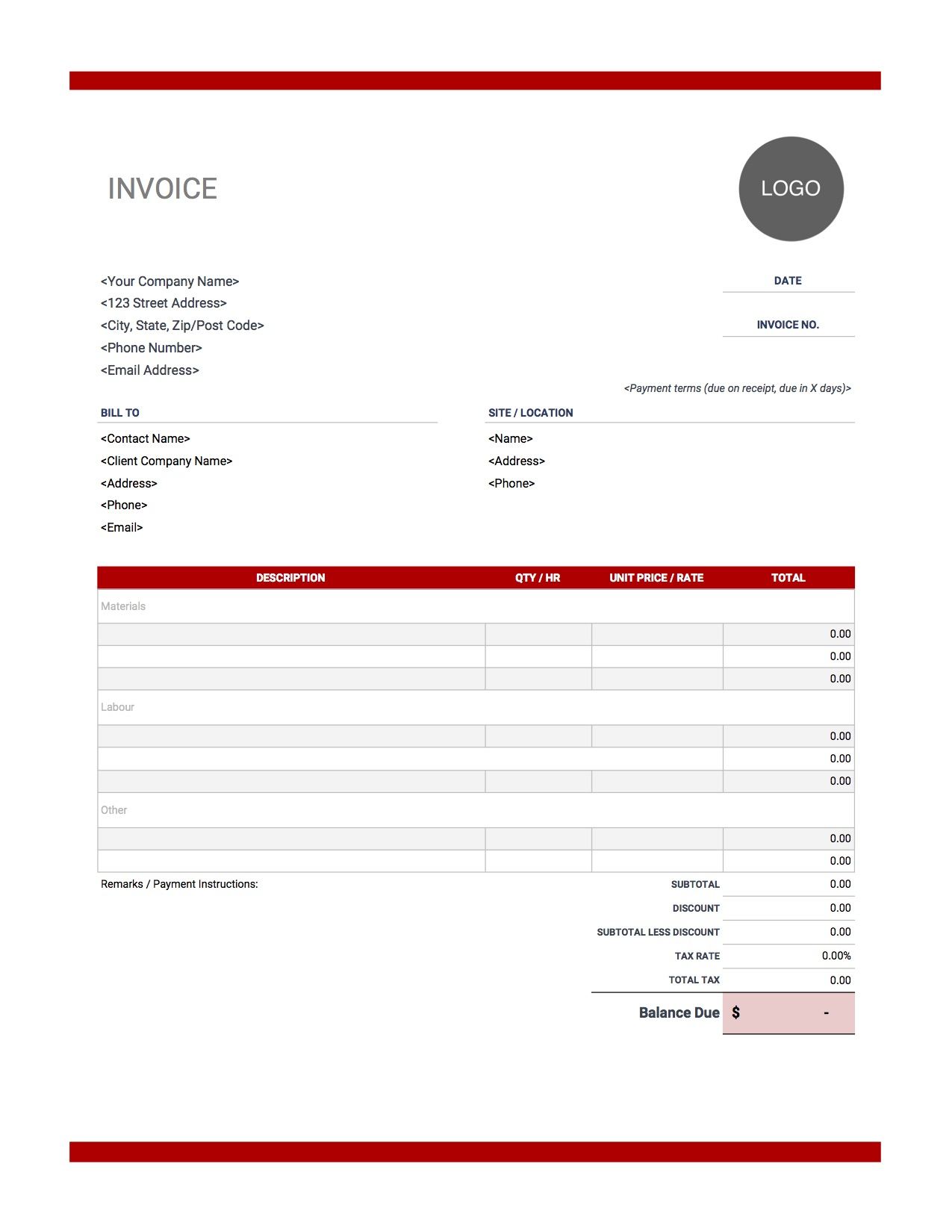

Construction Invoice Template Invoice Simple

Printable Simple Tax Invoice Sample With Tax Rate List Law Firm Receipt Template Pdf Invoice Sample Invoice Example Receipt Template

Sales Invoice Templates 27 Examples In Word And Excel